With parts of the market in clear correction territory, we keep hearing about “bonds” and “yield curve”. This is a lesson for beginners, the stock market is more than buying and selling pieces of companies. We have to understand factors that can affect the market. Often, as investors and traders, we ignore bonds because they’re seen as super conservative investments.

Generally, when you hear the term “bonds”, people are referring to, notes, bills, or actual bonds. Treasury Bills have the shortest term spanning from weeks to a year. Treasury Notes span from two to ten years. Treasury Bonds have a duration of 20 or 30 years. You’ll sometimes see Treasury notes, bonds and bills referred to as T-notes, T-bonds or T-bills.

At the most basic level, bonds (bills/notes) are I.O.U’s. Governments issue Treasury Bonds and businesses issue Corporate Bonds because they need cash.

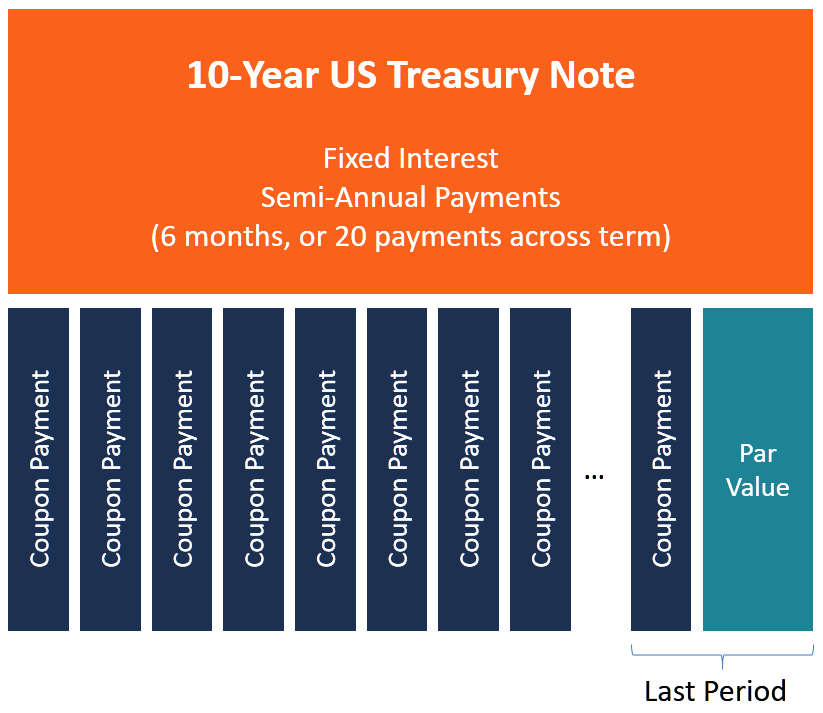

Heres an example:

In this example of a 10 year Treasury Note, interest is paid every six months. This means you give your investment to the US Government and every six months they pay you a set interest payment. The last payment is interest plus your investment.

Now, understand there are several types of assets to grow your money. US Treasury bonds (bills/notes) are considered safer investments because unlike individual stocks or Corporate Bonds, the US Treasury is less likely to fail. Understand that bonds are just conservative investments. The US government clearly has no problem printing more cash, so bond repayment isn’t seen as an issue.

Bills, Notes and Bonds are all just “fixed income” investments, meaning the return on investment is unchanging for the term. Some people value a level of certainty in the future, even if the return could be less than the return found in other assets.

The 10-year Treasury Note has become an indicator of investor confidence in the market. If investors feel good about the 10-year timeframe, then the demand (price) of longer-term fixed-income securities falls. When demand is low, yield or return on investment rises because those same bonds are cheaper in price.

Buying the same note at a lower price means your return on investment (yield) is higher. The opposite is that as investors are less confident about the 10 year period, demand (prices) rise and yield falls. Basic supply and demand tells us as things become more demanded, the price should rise, and when things are less demanded, then price should fall.

Generally, fixed income yields are lower for the short term because your money isn’t “tied up” for as long. In the case of longer-term fixed-income investments, you tend to see higher yields compared to short term, because think about it, if I’m "locking my money up” in this investment for years, then it needs to be worth my time.

NOW…. why does any of this matter, since I’m not close to retirement and not looking for safe investments?

When demand for T- notes are low, the yield is higher, which could make them more attractive purchases. When T-notes are in low demand that could mean confidence in the future is high. Major headlines keep saying the yield curve is steepening, which means that yield is rising on longer term bonds. At some point, we could see investors will start moving their cash out of the market and take advantage of those rising yields and safer investments.

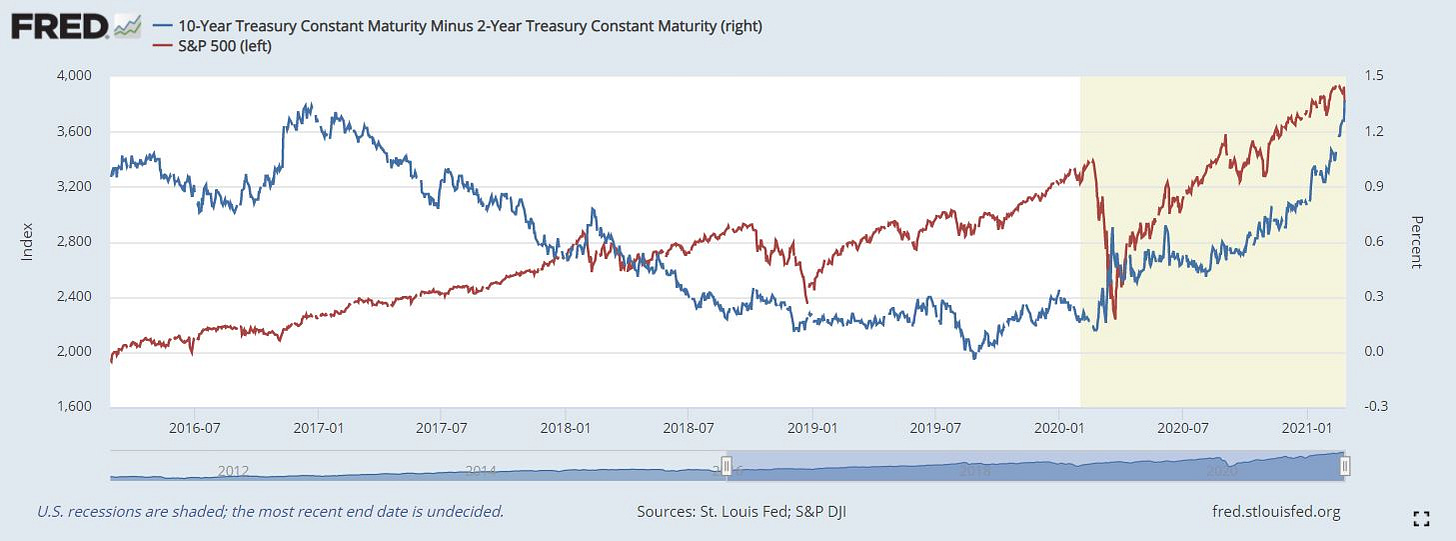

When you look at this chart, you see that the S&P 500 and the yield curve usually move opposite of each other. This is spooking the market because this could indicate that a decline in the S&P is coming as yield continues to increase. The 10 year T-Note is just one indicator that can help us understand the stock market.

On the heels of yet another stimulus payment, is inflation near? The Fed says everything is undercontrol so ultimately the rise in bond prices is speculation. We really don’t know what’s to come but you know the market doesn’t like uncertainty. The Fed says they’re committed to an inflation rate around 2%, and we have seen them utilize their tools to prop up the market thus far.

Some people may say that the rise in bond yield isn’t actually uncertainty, but just the fact that the economy is is recovering, so demand for bonds is down; it really depends on who you ask. Long term inflation is not good for bonds, for example if this bond pays 2% interest and inflation is 3%, then really I’m losing money. Why would I want to lock my money up for 10 years and not benefit? If the economy is infact doing better, will interest rates stay low, as promised? If interest rates rise, then access to capital becomes more expensive and we will definitely see a reaction to that in the stock market.

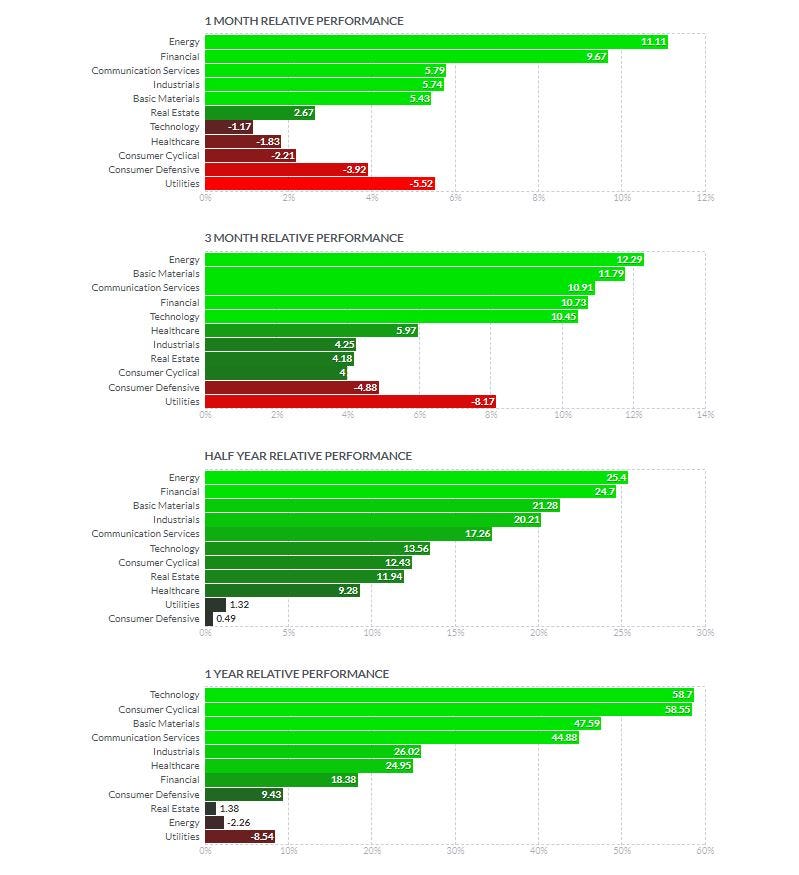

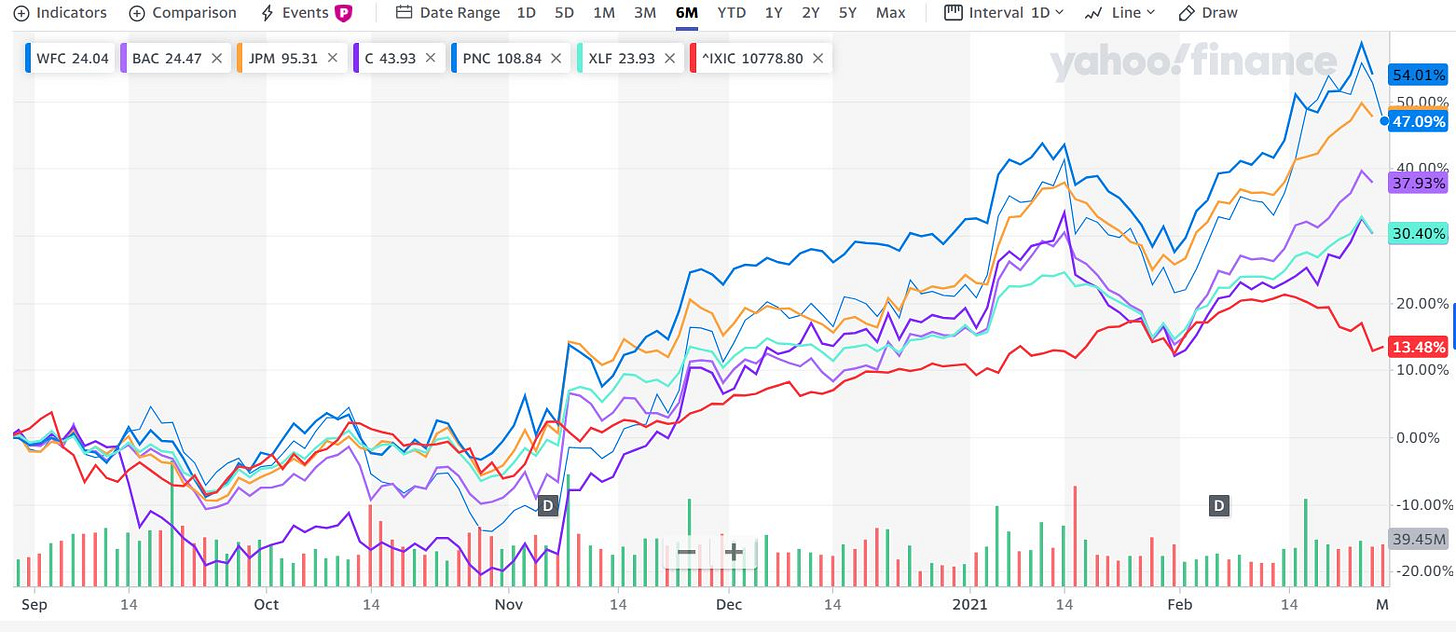

Keep in mind the financial sector has been a laggard as tech has benefitted from low interst rates. Financial institutions benefit more from higher interest rates (or speculation of higher rates to come) as we can see here:

We see technology stocks lagging, in the last month but financials are up since about November. Heres a visual of what I mean. You see financials up 30-50% while the Nasdaq (red) is up only 13%

Like I said in the beginning, the stock market is more than buying and selling pieces of companies. Understanding outside factors can help you in your trading or investment plan.

Is tech done?

Hopefully you took advantage of the recent red days in the market and saw them as buying opportunities. Remember, short term volatility is going to happen, so think long term. Sector rotation happens, but remember that stock market leaders don’t always just go up. Sector rotation is a good thing because we don’t want a bubble. We dont’t want large amounts of capital concentrated in one place. It’s good to see other sectors “waking up”.

Long term are you betting on banks?

These are all things to consider. The weekend is for research, so do some digging and make sure you stick to your plan for the long term.

Happy Sunday!

Awesome explanation