In many ways, COVID has sped up changes that were already on the horizon. One of those changes is the fact that things are overwhelming more digital. From virtual school, work from home, 5G, gaming, and artificial intelligence, companies in these industries have benefitted from the change in the economic landscape. Last year we saw a major increase in the need for more electronic devices in general, which stressed supply.

Looking at the Finviz heat map of this past week, you see SMH as one of the leaders. SMH is the Semiconductor ETF. Semiconductors (chips) are essentially the “brain” of electronic devices. As we increase our reliance on electronics, we are also increasing our reliance on semiconductors to “think” faster and become smaller in electronic devices.

With that being said, we need semiconductors, they’re essential to our current way of life and ultimately crippling to our future if we were without them.

Currently, the world is experiencing a semiconductor shortage, but what does that really mean? GM announced that it’s shutting down production in three locations because semiconductors are a necessary component of cars. They’re prioritizing the semiconductors they do have for their most profitable products. Many automakers lowered their expectation of automobile production/sales with the onset of Covid/limited traveling, but unexpectedly automotive demand is up, as the road to the new normal becomes more and more apparent. Remember that in the midst of early Covid lockdowns many factory operations were affected. All chips are not created equal, so we will see certain industries and products within those industries affected more or less.

“It is difficult for us to increase production of the PS5 amid the shortage of semiconductors and other components. We have not been able to fully meet the high level of demand from customers (but) we continue to do everything in our power to ship as many units as possible to customers who are waiting for a PS5." - Hiroki Totoki Sony's CFO in the company's FY Q3 2020 earnings call.

As a result of the shortage, we have seen Joe Biden mention a potential executive order to address the shortage. There does need to be a strong semiconductor production industry in the US, but currently there isn’t.

Understand that most semiconductors are made by a handful of companies, which means that even if Biden wants to expand production into the US, it literally cannot happen in the foreseeable future. It takes time to build infrastructure for production. This means that companies like TSM, AMD, Intel, QCOM, Nvidia, Samsung, LRCX, and Broadcom will have to rise to the occasion. TSM is actually the largest semiconductor manufacturer.

Ok, so what? As an investor what does this mean? How can investors make money off of this global event?

My outlook on this situation is really summed up in this quote:

"While there's been some debate about whether shortages will be good or bad for the (semiconductor) group, our view is that such a supply/demand imbalance is unquestionably positive for the semi suppliers. Historically, when semis are in shortage, it has been favorable to pricing." - Raymond James semiconductor stocks analyst Chris Caso in a note to clients.

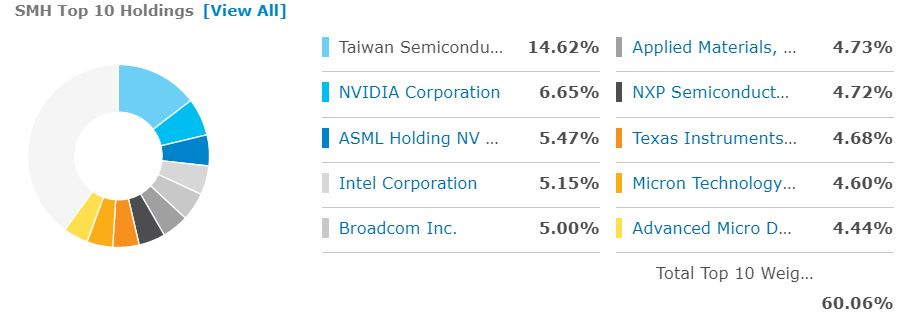

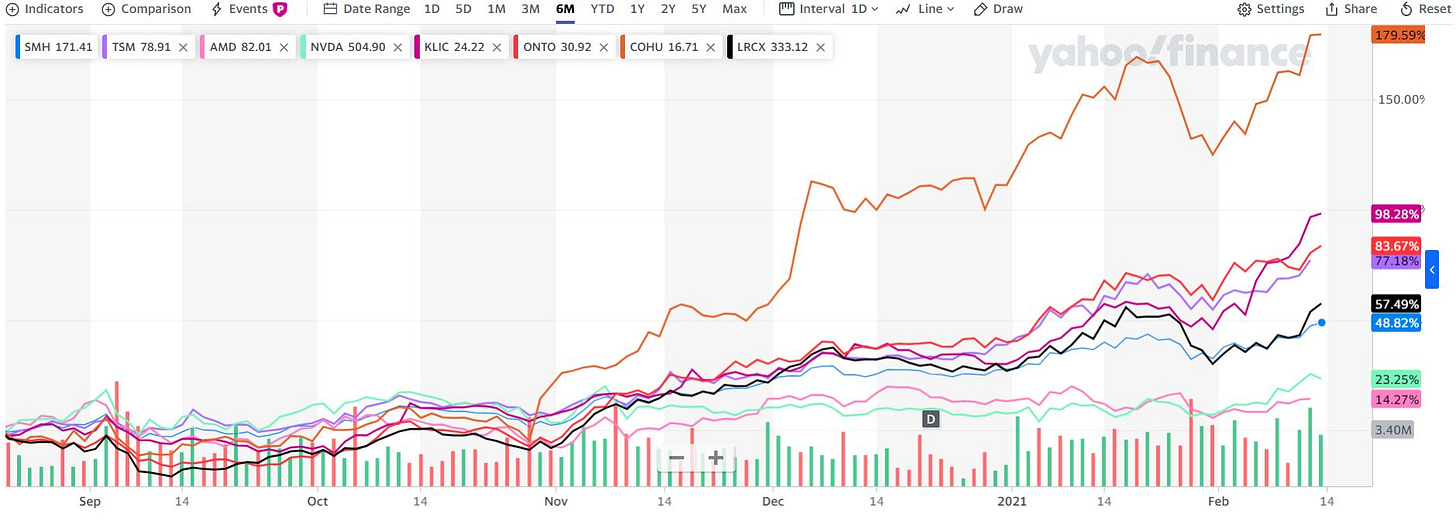

With semiconductors in high demand, TSM is a great play. I mentioned the semiconductor ETF SMH earlier.

ETF’s a great way for sector exposure, without having to individually pick the leader or who you think will benefit the most.

Another way to play this situation is to look at industry synergies. Kulike and Soffa (KLIC) is a semiconductor assembly company. Here’s a statement from their CEO:

Fusen Chen, Kulicke & Soffa's President and Chief Executive Officer, stated, "Demand has increased significantly in the December quarter driven by strength in the general semiconductor, LED and automotive markets. Additionally, we have supported more complex, high-volume semiconductor assembly, which is increasing the capital intensity and longer-term opportunities within our served markets."

From a business standpoint these semiconductor companies are telling you they see increased demand. There will be short term hiccups like the stock overreaction with QCOM, but in the long run, I believe these companies stand to benefit as all roads lead back to them for semiconductors. We may see companies try to produce semiconductors internally, but again how fast can that be realized, and how well can they actually do it? Intel said they were making their own 7nm chip but admitted they didn’t expect it til 2023 (major fail)… meanwhile AMD has 7nm chips now.

Other tickers to consider are COHU, and ONTO; as always do your own research. Also, keep this in the back of your mind, if everyone is ramping up production and Biden is pushing for US production, could we see over production down the line? Keep an eye on production numbers as orders are filled and the “shortage” goes away into 2022. Will the world keep needing more chips or will demand level off?

I love doing deep dives into companies, and I realize that many people just don’t know where to start. If you’re in need of tips and more education on how to do fundamental analysis, then let’s talk in a 1-1 session.

Happy Sunday

Thank you. This was the insight and confirmation I needed after seeing COHU repeatedly.